Slovak legislation allows every taxpayer to donate a certain percentage of his or her paid tax to a non-profit organization.

How can you participate in the development of EFIB, thanks to your taxes?

1/ You are an employee:

– Before February 17: ask your main employer to prepare your Income Tax Return and your Tax Payment Certificate (POTVRDENIE o zaplatení dane).

– Download and fill in the document VYHLÁSENIE o poukázaní podielu (pre-filled with the details of the Association for a French School in Bratislava; EFIB). Fill in the amount corresponding to 2% (or 3%) of the tax paid (minimum 3€). Do not forget to date and sign it.

– By April 30 at the latest: send these 2 documents (POTVRDENIE and VYHLASENIE) to the tax administration body you depend on, or directly to the central office: Daňový úrad Bratislava, Ševčenkova 32, 850 00 Bratislava 5.

– If you would like to inform us about your 2% donation, please check the corresponding box indicating your consent to the transmission of your details to our association.

2/ You are an individual entrepreneur or a company:

Self-employed entrepreneurs can donate up to 2% (or 3%) of their taxes to our institution.

Legal entities (companies) can donate 1% (or 2%) of their taxes.

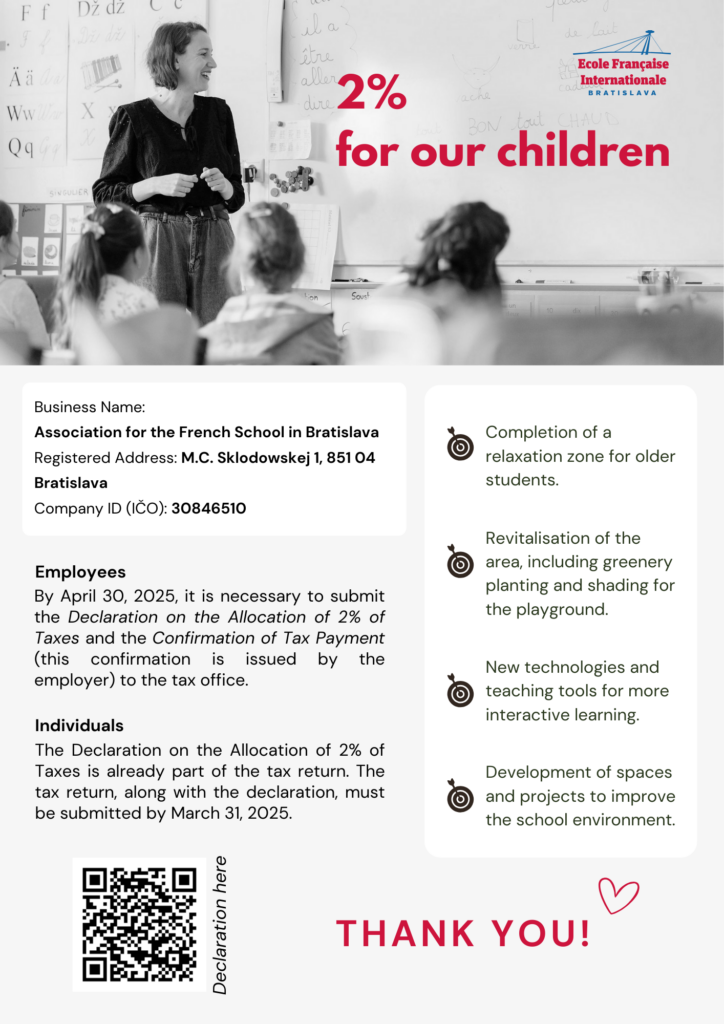

Before March 31: indicate in your tax return, in the section “Vyhlásenie o poukázaní podielu zaplatenej dane”, the contact details of the Association for a French School in Bratislava:

- IČO / SID: 30846510

- Obchodné meno / Name: Združenie pre francúzsku školu v Bratislave

We remain at your disposal to answer your questions:

+421 905 887 508

Thank you very much to all those who will be supporting us.

The Management Board of the Association for a French School in Bratislava